Compound interest Albert Einstein

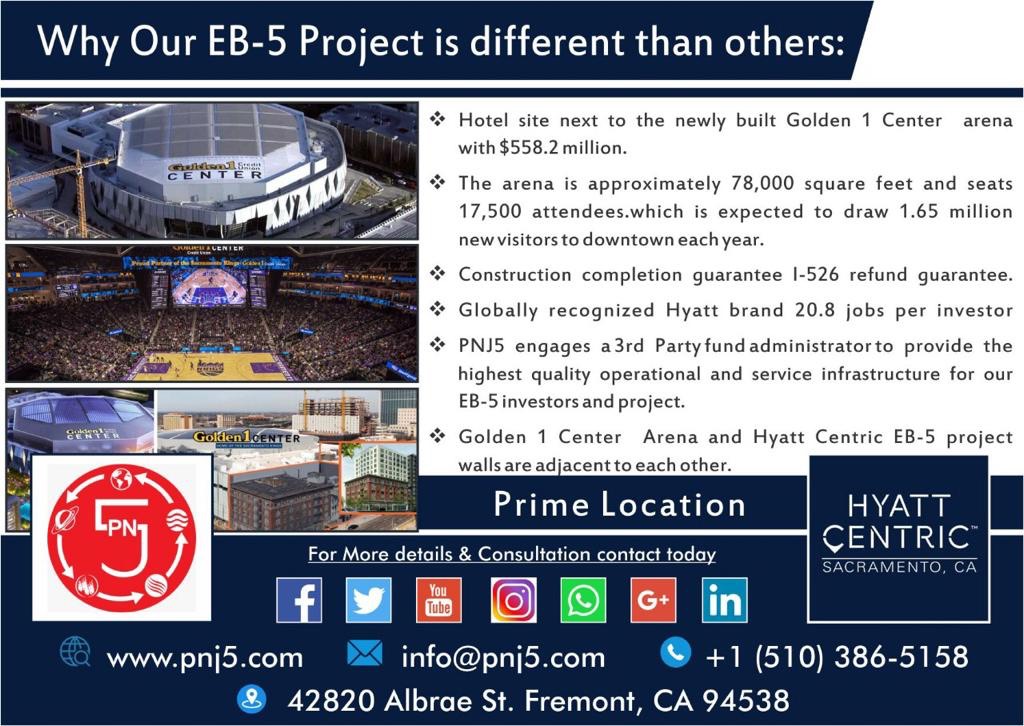

This compounding effect can be very powerful over a long period of time. People that save early and keep adding to their savings can reap the rewards of compounding. Now granted, 10% is a high rate of return, and not realistic to expect for most investors. Stock Market as measured by the S&P 500 Index (a mix of 500 U.S. Companies) since 1927 has been about 10% according to Investopedia.com. The only return that matters is your long-term return, and, for most asset classes, your long-term investment return is reasonably predictable.

- The exceptions to the rule regress back to where they should be over time.

- Nobody has that kind of money to save for their kids.

- We need to come up with an average (mean) that we can use to derive the answer using just the mean value and the time period.

- This isn’t the world I want my daughter to grow up in.

- Interest only accrues on the principal amount that is invested or borrowed.

So let’s pretend that’s exactly what I did rather than correcting my actions. An investor focused on compounding interest will instead look for the company that is growing slowly and surely. Like the slow tortoise, conservative investments beat out high flying “trendy” stocks. variable consideration After 10 years, you are earning $23.58 in interest when you only earned $10 in interest in year 1. The rate is the same (10%), but you are earning it on more money each year. Finally, converting R from a decimal into an, easier to use, percentage requires multiplying by 100.

Formula for calculating principal (P)

If you invest your capital at that rate for 10 times as long (50 years), you will not multiply your wealth by 16 times. If you came of age around 2007, chances are you don’t remember a time when banks offered you a significant interest rate on your savings. Maurie Backman is a personal finance writer covering topics ranging from Social Security to credit cards to mortgages. She also has an editing background and has hosted personal finance podcasts. The rule of 72 is a quick, easy way to calculate how long it will take for an investment to double based on the interest rate. This is important because you need to be able to compare apples with apples.

If you were grading exam papers, you might want to calculate the arithmetic mean. This is typically what most people think of when they talk about the ‘average’. Their percentage growth rates over four years are shown below.

Albert Einstein > Quotes > Quotable Quote

That might not seem like much, but understanding that simple fact can have a major impact on your financial success. The possibility of this is all due to compounding interest. By investing in companies that are growing, an initial investment could multiply many times. All of these are great averages, and each has uses, but for our compounded interest they will not help. We need to come up with an average (mean) that we can use to derive the answer using just the mean value and the time period. If the interest rate were constant that would be easy.

After 10 years, your original $1,000 would become $2,010. That means your annual interest would be $1,010 – more than your original investment. The longer you leave your money untouched, the more powerful the compounding effect becomes.

Compounding interest can create millionaires from average people.

Thanks to the power of compounding, you’d earn $34,370 in the third decade compared to $26,612 in the first two decades – that’s 29 per cent more money in half the time. Having a longer investment horizon is important as the effect of compound interest may not be obvious in the short term, but will be realised over time. While young people may not have much money to invest with, time is on their side and they are in the best position to take advantage of compound interest to accumulate wealth. The above example of doubling a dollar a day may sound unrealistic. However, in the real world, many do expect to have their investment returns double within a short period of time But the fact remains, the higher the potential returns, the higher the risks.

I have coworkers and friends that will go out to eat every single day for lunch. Some days they’ll spend $7, others it’s $20, but on average I would say it’s likely right around $12, especially if you’re sitting down somewhere. Nowadays it’s somewhat hard to go out to eat for under $10, and then you can tack on a 20% tip and end up at $12 pretty quickly.

How to make money from the sharing economy in 2019

The concept is that when you earn interest in X amount of time, that next time period you’re going to earn interest on the principal AND the interest that you previously earned. Basically you’re double dipping on return on your investments. That being said, the market almost never returns anything near the average. Only 6 times in that span has the market returned between 5% and 10%. It usually returns much higher or much lower than 10%. These big swings can make it very difficult for investors to stay invested and actually earn the high return, but that is a conversation for another time.