Financial statements are usually prepared the _______ of financial year

The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing. Below is a portion of ExxonMobil Corporation’s income statement for fiscal year 2021, reported as of Dec. 31, 2021. Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time. Expenses that are linked to secondary activities include interest paid on loans or debt. Primary expenses are incurred during the process of earning revenue from the primary activity of the business.

Your business’s financial statements give you a snapshot of the financial health of your company. Without them, you wouldn’t be able to monitor your revenue, project your future finances, or keep your business on track for success. Investors and financial analysts rely on financial data to analyze the performance of a company and make predictions about the future direction of the company’s stock price. One of the most important resources of reliable and audited financial data is the annual report, which contains the firm’s financial statements.

Income Statement

Financial statements are also read by comparing the results to competitors or other industry participants. By comparing financial statements to other companies, analysts can get a better sense of which companies are performing the best and which are lagging behind the rest of the industry. Below is a portion of ExxonMobil Corporation’s cash flow statement for fiscal year 2021, reported as of Dec. 31, 2021.

- Your assets are items of value and things that your business owns.

- Read on to learn the order of financial statements and which financial statement is prepared first.

- Financial statements are written records that convey the business activities and the financial performance of a company.

- Your cash flow might be positive, meaning that your business has more money coming in than going out.

- Although financial statements provide a wealth of information on a company, they do have limitations.

Financial statements provide all the detail on how well or poorly a company manages itself. After you generate your final financial statement, use your statements to track your business’s financial health and make smart financial decisions. Prepare your cash flow statement last because it takes information from all of your other financial statements. Create your balance sheet and include any current and long-term assets, current and noncurrent liabilities, and the difference between your assets and liabilities (aka equity). Your balance sheet is a big indicator of your company’s current and future financial health. You can also use your balance sheet to help you make guided financial decisions.

Which Financial Statement Is Prepared First?

You can even use your cash flow statements to create a cash flow forecast or projection. A cash flow projection lets you estimate the money you expect to flow in and out of your business in the future. Forecasting your business’s future cash flow can help you predict financial problems and give you a clear picture of your company’s financial future.

In ExxonMobil’s statement of changes in equity, the company also records activity for acquisitions, dispositions, amortization of stock-based awards, and other financial activity. This information is useful to analyze to determine how much money is being retained by the company for future growth as opposed to being distributed externally. This information ties back to a balance sheet for the same period; the ending balance on the change of equity statement is equal to the total equity reported on the balance sheet. Investing activities include any sources and uses of cash from a company’s investments in the long-term future of the company.

Overview of financial statements

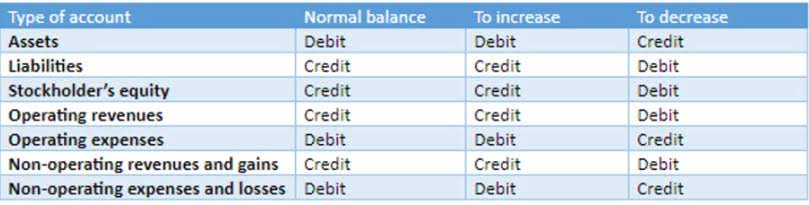

Expenses include the cost of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D). The following video summarizes the four financial statements required by GAAP. Your cash flow might be positive, meaning that your business has more money coming in than going out. Or, your company could be in negative cash flow territory, which indicates that you’re spending more money than what you’re bringing in. A/An is the financial statement showing the expected income and expenditure of the government during a financial year. Is prepared at a particular date usually the end of the financial year, while the ……….

Nonprofit entities use a similar but different set of financial statements. Financial statements are the ticket to the external evaluation of a company’s financial performance. The balance sheet reports a company’s financial health through its liquidity and solvency, while the income statement reports a company’s profitability. A statement of cash flow ties these two together by tracking sources and uses of cash.

Your total assets must equal your total liabilities and equity on your balance sheet. This statement will show you how cash has changed in your revenue, expense, asset, equity, and liability accounts during this accounting period. An often less utilized financial statement, a statement of comprehensive income summarizes standard net income while also incorporating changes in other comprehensive income (OCI).

Together, financial statements communicate how a company is doing over time and against its competitors. The balance sheet, lists the company’s assets, liabilities, financial statements are typically prepared in the following order and equity (including dollar amounts) as of a specific moment in time. That specific moment is the close of business on the date of the balance sheet.

Unit 2: Accounting Principles and Practices

Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income statement provides an overview of revenues, expenses, net income, and earnings per share. Use your net profit (or net loss) from your income statement to prepare your statement of retained earnings. After you gather information about your net profit or loss, you can see your total retained earnings and how much you’ll pay out to investors (if applicable). Your statement of retained earnings, or statement of owner’s equity, lists what your business’s retained earnings are at the end of an accounting period. Retained earnings are profits you can use to pay off liabilities or make investments.

- Your total assets must equal your total liabilities and equity on your balance sheet.

- By comparing financial statements to other companies, analysts can get a better sense of which companies are performing the best and which are lagging behind the rest of the industry.

- Operating activities generally include the cash effects of transactions and other events that enter into the determination of net income.

- After you gather information about the net profit or loss, you can see your total retained earnings and, if applicable, how much you will pay to investors.

- The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential.